On January 18, 2022, the Chinese Communist Party (CCP)-controlled Chinese media outlet Global Times published an article titled "The Global Energy Transition Is Accelerating." The article was authored by Niu Xinchun, research professor and director of the Institute of Middle East Studies at the China Institutes of Contemporary International Relations (CICIR), a leading think-tank affiliated with China's Ministry of State Security (MSS) and overseen by the CCP Central Committee.

The article was published following a January 10-14, 2022 visit by foreign ministers from four of the six Gulf Cooperation Council (GCC) countries, accompanied by GCC Secretary-General Nayef Al-Hajraf, to the northeastern Chinese city of Wuxi, in Jiangsu province. A high-profile visit by Turkish and Iranian foreign ministers followed, and that entire week of January was dubbed "Middle East Week" by Chinese diplomats and academics.

In his article, Niu wrote that Middle Eastern oil-producing countries had recently demonstrated "unprecedented enthusiasm for furthering their relations" with China, and that the Middle East was clearly departing from the "American orbit," with both U.S. allies and adversaries "looking east" as well.

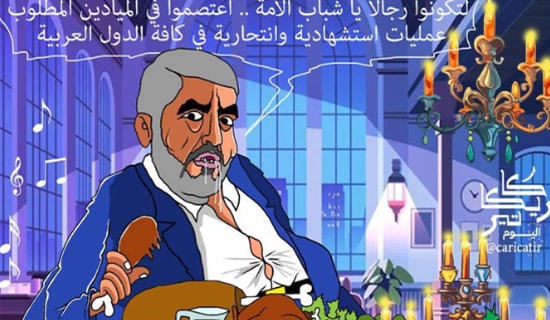

(Source: Opinion.huanqiu.com)

As China draws closer to Riyadh and Moscow, he concluded, in the future it may be China, rather than the U.S., that coordinates oil prices with Saudi Arabia and Russia.

Below is Niu's article:[1]

'There Have Been Clear Signs Of Warming Relations Between China And The Middle East'

"This year is shaping up to be a big year in China-Middle East relations. Six Middle Eastern foreign ministers and the Gulf Cooperation Council (GCC) secretary general visited China in close succession at the start of the new year, and Saudi Arabia will host the first China-Arab Leaders Summit later this year.

"In recent years, there have been clear signs of warming relations between China and the Middle East, particularly in light of the strategic contraction of the U.S. in the Middle East, making the phenomenon of a 'rising East and declining West' all the more striking.

"In the author's view, this is a result of the global energy transition as well as a reflection of the changing global power dynamics. China-Middle East interdependence is growing, with China's maneuvering room expanding and its Middle East policy facing unprecedented opportunities.

"Despite the fact that oil's importance has diminished as a result of the global energy transition, the Middle East continues to be the largest player in the oil market. Energy transition is a long process, with coal taking 200 years to replace the dominance of plant-based fuels and oil taking 100 years to replace coal. Even under the most optimistic scenario of carbon neutrality by 2050, the world would still need 24 million barrels of oil per day.

"In this process, the Middle East enjoys a competitive advantage due to its large oil reserves, low cost and low carbon footprint of production. Other countries' oil will be the first to leave the market, allowing the Middle East to increase its market share. In 2020, the Middle East accounted for 34% of global oil production, with the possibility of exceeding 50% in the future.

"China is the world's largest crude oil importer, and its influence in oil politics is growing. The gap has widened since China overtook the U.S. as the world's largest importer of crude oil in 2017. In 2020, China imported 10.85 million barrels per day of crude oil, compared with 5.87 million barrels per day for the U.S. China was also the largest importer of Middle East crude oil that year, importing nearly 5 million b/d compared with 700,000 b/d for the U.S.

"More importantly, when China became the world's largest crude oil importer, the oil market shifted from a seller's to a buyer's market, and oil importers' position improved...

"The Middle East needs China's market and investments, and China needs the Middle East's oil, making the two sides interdependent. In contrast, the demand for Middle East oil from the U.S. and Europe is rapidly declining. In 2020, all European countries and the U.S. together accounted for 19% of Saudi Arabia's crude oil exports, while China accounted for 26%. It is clear that the interdependence between the Middle East and China will gradually increase.

"The trend of a 'rising East and declining West' is also evident in the field of investments. Companies in Europe and the U.S. have recently divested from the oil and gas markets because they are pessimistic about their prospects. ExxonMobil, Chevron, BP, and Shell, among other U.S. and European multinational oil companies, have sold $28.1 billion in assets and plan to sell another $30 billion, leaving the industry with $140 billion in assets on market.

"Upstream oil and gas investment in 2021 was $315 billion globally, down 30% from the previous year and 60% less than the 2014 peak. The European Investment Bank stopped financing fossil fuel projects in 2021, per the European Commission's 2050 roadmap to carbon neutrality. In 2010, China accounted for 2.4% of FDI stock in the Middle East, rising to 5% in 2019; similarly, in 2010, China accounted for 3.3% of FDI flows in the Middle East, rising to 10.1% in 2019. Clearly, the Middle East desires Chinese investment as well.

"As the Middle East 'lifts its head' in anticipation of the new energy sector, China appears to be the ideal partner, with the world's largest production capacity. China is a global leader in solar and wind energy production and consumption, having invested nearly $900 billion in renewable energy since 2009, more than twice as much as the U.S. China currently produces more than 70% of the world's solar panels and 50% of the world's wind turbine manufacturing capacity; it is also the world's largest manufacturer of electric vehicles, with nearly half of the global total and 77% of lithium ion batteries.

"Originally, the U.S. was the technological leader in nuclear power sector, but it has not developed any new projects since 2007. Russia, China and France are particularly active in the international nuclear market. Egypt, Saudi Arabia, and the United Arab Emirates have all announced new energy targets, with Egypt aiming for 42% renewable energy by 2030, Saudi Arabia for 50% by 2030, and the UAE for 44% by 2050. To achieve these ambitious goals, the Middle East needs a significant amount of new energy capacity, where China has a distinct advantage."

'The Middle East Is Clearly Departing From The 'American Orbit,' With Both U.S. Allies And Adversaries 'Looking East''

"The international oil market's transformation has occurred at a time when the international political landscape is undergoing significant changes. The Middle East had been dominated by the U.S. since the end of the Cold War, particularly in security [affairs], leaving little room for China to play an active role. American and European companies monopolized the Middle East economy's upstream industries, and China had no say in the matter.

"Now, the U.S.'s strategic contraction in the Middle East is becoming more evident, with Middle Eastern countries hedging their bets on both sides of the table, if not multiple sides of the table, leaving China with significantly more room to expand. In light of this, Middle Eastern oil-producing countries have recently demonstrated unprecedented enthusiasm for furthering their relations with China and have been open in areas such as the oil yuan, upstream oil and gas explorations and production, and long-term bulk oil supply contracts.

"The Middle East is clearly departing from the 'American orbit,' with both U.S. allies and adversaries 'looking east' as well. According to Emirates University political scientist Professor Abdulkhaleq Abdulla, Gulf countries have lost faith in the U.S. The U.S. influence is waning, not only in the economic sphere, but in all aspects of politics, military, and strategy.

"Stabilizing international oil prices necessitates full cooperation between oil-producing and consuming countries. Since 1973, most oil crises have entailed cooperation between the U.S. and Saudi Arabia to control oil prices by reducing or increasing production.

"In 2020, when the world saw a rare ultra-low (negative) oil price, then-President Trump called Saudi Crown Prince Salman and Russian President Vladimir Putin to discuss how to stabilize oil prices. However, when the U.S. considered oil prices to be too high at the end of 2021, President Biden did not call Saudi and Russian leaders, instead lowering oil prices by releasing crude from the Strategic Petroleum Reserves.

"The reason for this is that the recent deterioration of relations between the U.S. and Saudi Arabia, as well as Russia, has harmed coordination between the three nations. At the same time, China is getting closer to Saudi Arabia and Russia. Perhaps, in the future, it will be China, rather than the U.S., that coordinates oil prices with Saudi Arabia and Russia. At that point, it will be another landmark event in this period of changes unseen in a century."

[1] Opinion.huanqiu.com/article/46RgKHkwWDC, January 18, 2022.